Learn The COBRA Compliance Rules And Requirements - And Earn A Certified COBRA Administrator Designation!

If your organization offers health insurance to employees, you need to understand the Consolidated Omnibus Budget Reconciliation Act (COBRA). Compliance with this law is essential, but you also need to reduce your organization's liability. COBRA training can help you comprehend this complex regulation and balance your employees' needs with your company's interests.

What Are The Key Areas - And Problems - For Good COBRA Administration?

Good COBRA administration is essential for both employers and employees to ensure compliance with federal regulations and smooth continuation of healthcare coverage. Here are some key aspects for which you need to be on top of your game:

- Understanding COBRA Regulations

- Keeping accurate records

- Correctly handling Qualifying Events

- Timely Notification

- Enrollment Process

- Premium Collection

- Compliance Monitoring

- Coordination with Third-Party Administrators (TPAs)

- Communication and Support

- Staff Training

- Keeping Updated On The Law

By focusing on these key areas, employers can effectively administer COBRA coverage, maintain compliance, and support continuity of healthcare benefits for eligible employees and their beneficiaries.

Why Enroll In A COBRA Certification Program

HR departments are typically responsible for compliance with COBRA. Understanding your organization's COBRA requirements can be challenging even for the most experienced professionals, especially because the Act comes with certain exceptions. Failing to comply with COBRA proves costly, so you need to follow the law exactly. Bottom line, enrolling in a COBRA training program allows you to take control of your company's compliance.

Learn COBRA Requirements For Employers, Plus Get COBRA Certified!

COBRA, short for the Consolidated Omnibus Budget Reconciliation Act, gives individuals the option to maintain their employer-sponsored health insurance after job termination or other qualifying life events. This ensures temporary coverage to prevent gaps in health coverage, allowing individuals to stay on their existing health plans and continue accessing care.

With changing rules, regulations, and court cases, being COBRA compliant is extremely complex. Employers that fail to understand their COBRA requirements and use proper procedures and design options can create financial and legal risks. This means companies rely on their HR professionals to understand COBRA and administer it properly.

Our COBRA Training &Certification Program - already used by thousands of companies and TPAs across the county - covers everything from the basics to advanced concepts, and will provide the answers to your questions regarding COBRA administration and COBRA compliance.What You'll Learn:Our COBRA online certification training course will help you to better understand your COBRA compliance requirements. Below are just some of the things you will learn by taking this course:

- Which employers are subject to COBRA

- What type of benefit plans are - and are not - subject to COBRA

- How an individual qualifies for COBRA

- What employers are required to notify employees and family members of

- The COBRA timelines for notification requirements

- The requirements for notifying employees and family members

- How to calculate and bill for COBRA premiums

- How - and when - to terminate COBRA Coverage

- How to properly offer and handle COBRA with Medicare and other coverage

- Facts for determining Cessation Of Dependency Status

- How to use Affirmative Rejection and Alternative Coverage design options to reduce health care and claims costs

In addition to covering COBRA administration at a deep level, this course also allows you to test to earn a COBRA certification! Upon successful completion of the course, you will receive your certification and eight hours of Society for Human Resource Management (SHRM) and Human Resource Certification Institute (HRCI) recertification credits.

Preview: Excerpts, Screen Shots, And Agenda

Preview: Excerpts, Screen Shots, And AgendaClick

here to full the Course Agenda.

Click

here to see some excerpts and demos from this training course.

Benefits Of The COBRA Compliance Training Program

Besides the great training, here are some of the additional benefits:

- Award-winning, easy-to-use interface that includes numerous "Administrative Tips" and examples that highlight key learning areas

- Procedural recommendations that provide key processes and procedures

- Special "Bookmark" feature that allows you to learn at your own pace and quickly return to training if you are interrupted

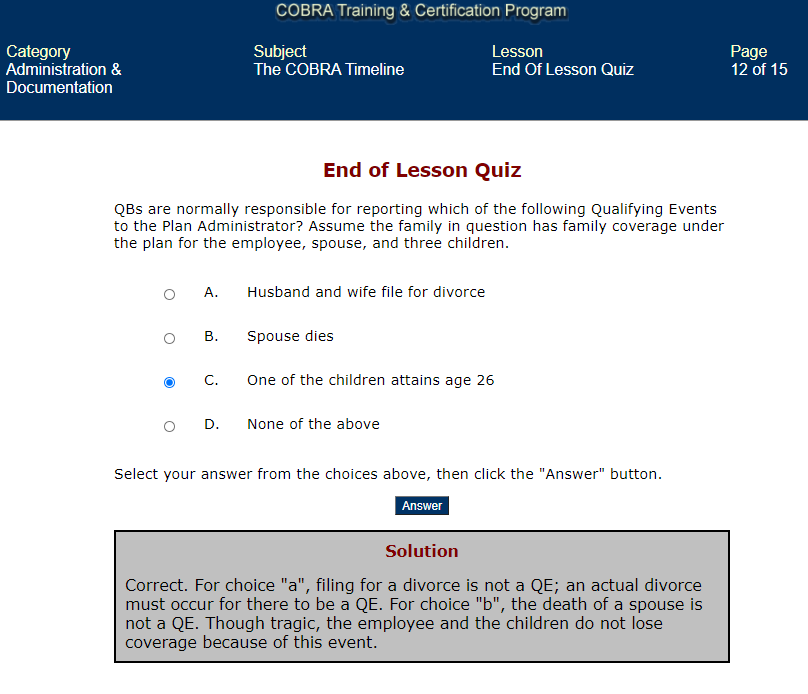

- Interactive Q&A with answer rationale provided to help ensure learning and check your progress along the way

- Self-paced option allows learners to study on their schedule

- Materials available anytime, anywhere

- Ideal for anyone responsible for COBRA compliance, including new or aspiring HR professionals, Office Managers with HR duties, business owners

- Eight hours of HRCI PHR and SPHR re-certification credits

- Eight hours of SHRM PDC re-certification credits

- Organizations enrolling three or more individuals also receive our Management Interface at no cost, allowing managers to view employee progress, test scores, and incorrectly answered test questions

- Included exam to earn a "Certified COBRA Administrator" designation

- Group discounts available

- FREE updates when the laws change helps your organization to stay up-to-date with regulatory changes - and avoid costly compliance errors and lawsuits!

FYI: This course is sold as an annual subscription with four components: the training course itself; access to all training materials as a resource for one full year; free updates whenever the law changes, and; a Certified Administrator designation. Each year thereafter, you have the option to continue access to your materials, updates, and a new Certificate for only $99 per year!

Further, organizations with 10 or more employees - either for your own company or as a TPA - requiring COBRA training can customize this course. Please call us at 770-410-1219 for details.

Top FAQs

In business since the mid-1990's, we have over 25 years of experience delivering high-quality training content via seminar, webinar, online, and other formats. Each of our courses are delivered by an industry expert who will share his or her years of experience to help you be in compliance, smarter, and more productive, and almost all offer SHRM and HRCI credits.

In addition to ensuring that employees are paid correctly and on time, "Payroll" has numerous time and reporting requirements. The primary payroll areas include paychecks, reporting, operations, and management.

Payroll Administrators must be able to:

- Properly "classify" workers

- Apply the various exemptions

- Calculate gross pay and properly make deductions

- Correctly identify, pay, and withhold taxes for employees

- Administer deferred compensation, cafeteria plan, sick pay, and other compensation

- Handle stock options, expense reimbursements, relocation, and other "expenses"

- Follow the proper policies, procedures, and documentation requirements for garnishments and levies

- Properly complete and file all required reporting requirements

- Correctly complete year-end requirements and establish year-beginning requirements

- Implement and maintain fraud, audit, disaster recovery, and record retention processes and procedures

While many payroll-related regulations are federally-governed, there also are many state requirements, including those for handling garnishment, final paychecks, and unclaimed paychecks. Each state's requirements differ in the details, so be sure to check your state's requirements by clicking the applicable link(s) at the bottom of this page.

Payroll is much more than just handing out paychecks, and includes a variety of responsibilities such as handling garnishments, travel pay, multi-state taxation, unclaimed paychecks, and much more in a timely and accurate fashion.

770-410-1219

770-410-1219