Payroll Certification Programs

Earn A Payroll Certification!

At HRTrainingCenter.com, we offer several payroll certification courses in both online and in-person formats that are designed to equip you with the skills needed to become a Certified Payroll Administrator or Certified Payroll Manager.

Each of our Certified Payroll certification classes uses our award-winning training interface and includes numerous examples, administrative tips, and interactive Q&A with answer rationales to help provide valuable insight into compliance requirements while testing your comprehension and application of payroll certification courses.

These Certified Payroll Certification courses online also allow you to learn at your own pace without time out of the office - and to earn payroll certification courses that can enhance your pay and your career!

Why Get A Payroll Certification?Payroll professionals have many challenges to navigate, from understanding different laws to managing multiple forms and reporting requirements. A payroll certification course can help professionals hone the skills, learn the knowledge, and develop the mindset they need to handle their various duties with efficiency and accuracy.

Benefits Of A Payroll Certification

Though most HR professionals will need at least some knowledge of payroll, the various payroll rules and concepts can be challenging to grasp, especially if you lack experience in accounting.

Though there are no specific educational requirements to work in payroll, some organizations require their HR employees to have payroll certifications or training on how to become a payroll professional. Even if your employer does not require you to get certified, taking payroll classes still offers many benefits. However, holding one or more certified payroll professional certifications shows potential employers you understand the field, increasing your chances of employment and promotion.

Here are a few of the benefits or earning a payroll certification:

- Professional Credibility and Recognition

- Validates your expertise in payroll laws, tax regulations, and compliance

- Demonstrates a commitment to your career and continued learning

- Enhances your resume and sets you apart from uncertified peers

- Provides career advancement, as advanced training is often required or preferred for mid- to senior-level payroll roles or for promotion or leadership opportunities

- Helps to minimize the risk of penalties or audits

- Improves productivity and financial accuracy

What You Will Learn With Our Payroll Certification Courses

Our online Payroll Certification courses are the cream of the crop when it comes to an all-around knowledge of being a payroll professional. These payroll certification courses prepare you to handle the day-to-day duties and challenges of payroll as well as discuss how to become a payroll specialist. Below are just a couple of the many items that you will learn about, namely; how to:

- Comply with various wage and hour laws and regulations

- Identify, pay, and withhold taxes

- Handle Cafeteria Plan, Retirement Plan, and other deductions

- Properly deal with garnishments and unclaimed paychecks

- Comply with the various forms and reporting requirements

- Correctly handle reconciliation needed as part of the year-end process

- Utilize the correct recordkeeping and documentation procedures

Not only do you learn more with a certified payroll professional certification, but having a payroll certification shows others your commitment to your job, giving employees more trust in your competency and making you more likely to receive a promotion when the time is right. There is also a good probability that a payroll professional certification will help you earn more money! Besides great training, you also receive:

- One full year of access to content

- FREE updates whenever the laws change or are updated

- FREE testing to earn designation

- A certificate, suitable for framing, showing your payroll certification

- 32 hours of HRCI's PHR and SPHR re-certification credits

- 32 hours of the Society for Human Resource Management's SHRM-CP and SHRM-SCP PDCs

Recommended Payroll Certification Courses

Our payroll specialist certification programs give you the management skills needed to feel confident as a payroll professional. Practically speaking, gaining a certified payroll professional certification will give you the well-rounded payroll skills to be successful in many roles within the payroll department. Simply click through to see more details about a specific payroll training area.

>>> Paycheck Fundamentals Training & Certification Program

Our Paycheck Fundamentals training course will teach you to properly:

- Identify, pay, and withhold taxes for employees

- Follow reporting and taxation requirements for tips

- Calculate supplemental wages

- Track deferred compensation, Cafeteria Plan, and other deductions

- Handle stock options, expense reimbursements, relocation, and other 'expenses'

- Calculate, deduct, and report Federal Income Tax withholding and FUTA taxes

- Handle garnishments, back-pay, sick pay, bonuses, awards, and gifts

- Understand 'Totalization Agreements'

- Make federal tax deposits

- Follow documentation and recordkeeping requirements

More Details / Order: HRTrainingCenter.com/paycheck-fundamentals-training-and-certification-program-ot1000061

>>>> Payroll Operations Training & Certification Program

By taking our Payroll Operations course, you will learn how to:- Maintain accurate payroll records, such as hours worked, pay, and tips and tax amounts

- Track, pay, and report Social Security, Medicare, and Federal Unemployment Tax Act (FUTA) deductions

- Track and process exemptions, fringe benefits, retirement plan deductions, garnishments, levies, and other deductions

- Distribute payments through checks, paycards, and/or direct deposit

- Retain records and forms, such as I-9s and eVerify

- Comply with various wage and hour laws and IRS regulations

- Establish and maintain self-service systems, direct deposits, and paycards

- Select and implement a payroll system

- Develop audit and disaster recovery plans

- Comply with various state and federal record retention requirements

More Details / Order: HRTrainingCenter.com/payroll-operations-training-and-certification-program-ot1000063

>>>> Payroll Reporting Training & Certification Program

Our Paycheck Reporting training course will teach you:

- The ins and outs of the 940, W2, and other reports

- When - and how - to use the Multiple Worksite Report

- When, where, and how to file (including electronically)

- Report using alternative IRS forms

- To properly complete and file all required reporting requirements

- Correct errors - even on forms already submitted!

- How to do 'Year End' and 'Year Beginning' work

...you'll even receive 'W-2', 'Year-End', and 'Year-Beginning' checklists!

More Details / Order: HRTrainingCenter.com/payroll-reporting-training-and-certification-program-ot1000062

>>>> Payroll Management Training & Certification Program

This course will teach you:

- To hire, train, and manage successful payroll professionals

- To establish and maintain self-service systems, direct deposits, and paycards

- To select and implement a payroll system

- To handle and work with audits and disaster recovery plans

- To implement anti-fraud plans

- To comply with the various record retention requirements

More Details / Order: HRTrainingCenter.com/payroll-management-training-and-certification-program-ot1000064

>>>> Certified Payroll Manager

This program combines all of the courses above to provide you with an extremely detailed training program for properly handling payroll.

This program combines all of the courses above to provide you with an extremely detailed training program for properly handling payroll.

Each of these courses uses our award-winning interface that provides plain-English descriptions of the various requirements, processes, and procedures, as well as numerous examples, administrative tips, and interactive Q&A with answer rationales to help provide valuable insight into compliance requirements.

And as opposed to purchasing the programs individually, you save over $500 by purchasing the complete program!

More Details / Order: Certified Payroll Manager

Program Demo: How The Payroll Training & Certification Programs Work

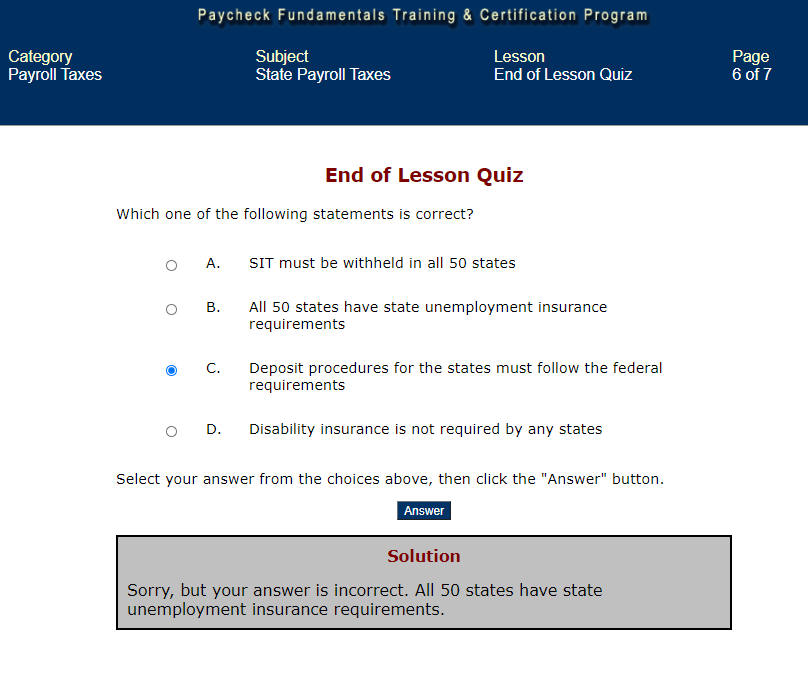

Our Payroll Training & Certification Program includes training that meets instructional design requirements. Namely, each Lesson starts with a Lesson Goals page that outlines the key items that will be taught in that Lesson, followed by multiple pages of training, and concludes with End Of Lesson Quizzes that test against the lesson goals. Read further for visuals and further explanations.

Example: Lesson GoalsEach self-paced Training & Certification Program is delivered right to your desktop at the time you choose, and is loaded with information, examples, administrative tips, and interactive questions to help you understand and comply with Federally-mandated rules and regulations. You will learn proactive design and administrative options, as well as key compliance processes and procedures to help reduce costs and health care claims, starting with a Lesson Goals page that tells you what you'll learn in that lesson.

Example: Benefit From Great Content, Easy To Use NavigationEach of our Training & Certification Programs includes great training content, written in non-legal terms and supported with numerous tips, examples, and procedural recommendations. "Glossary" and "Help" buttons also are included, as well as a special "Bookmark" feature so you can save your place as needed.

Example: End Of Lesson QuizLesson goals and learned content are tested through interactive questions during and at the end of each lesson. Answers to each question are provided right on that page to give you immediate feedback.

Earn A Certified Payroll Professional Certification!

And don't forget: upon completion of the Training portion of your Program, you can test for "Certification". Certification helps provide confidence to Managers that the person handling Payroll has a good understanding of the complex requirements necessary for proper compliance.

Other Payroll Training Classes

In addition to our payroll certification courses, we provide additional training opportunities through HR webinars. These payroll training courses are 90-minute presentations that cover specific topics. You can watch the presentations live to gain new information about focused payroll topics or watch the recorded versions on demand at any time.

Below are a few of the Payroll webinars and audio conference titles that we hold each year. To see specifics or to order a specific course, simply click the course title.

Learn More About Our Payroll Classes

Whether you want to advance your career or run your payroll office more accurately and efficiently, you can count on HRTrainingCenter.com to have the right payroll class for you. Explore our payroll certification courses to learn more, or give us a call at 770-410-1219 to speak with a knowledgeable representative about any questions you have.

Find Seminars, Webinars, And Online Training In Your Area

Why Choose One Of Our Payroll Certification Courses?

HRTrainingCenter.com is dedicated to helping HR professionals enhance their careers and develop essential skills that help them succeed. Since our founding in 1994, we have made training possible for thousands of companies, ranging from large corporations to small businesses. You can trust us to have the right courses for your needs.

Our award-winning courses are led by highly knowledgeable and experienced instructors. Whether you participate in one of our online or in-person classes, you will have opportunities to engage with experts through interactive activities and question-and-answer sessions that help you develop your understanding along with practical skills.

Start Working Toward Your Payroll Certification Today

At HRTrainingCenter.com, we have provided thousands of companies with payroll training, from large corporations to small businesses. When you're ready to become a Certified Payroll Professional, enroll in one of our payroll certification courses, or contact us for more information today.Why Choose One of Our Payroll Certification Courses?

HRTrainingCenter.com is dedicated to helping HR professionals enhance their careers and develop essential skills that help them succeed. Since our founding in 1994, we have made training possible for thousands of companies, ranging from large corporations to small businesses. You can trust us to have the right courses for your needs.

Our award-winning courses are led by highly knowledgeable and experienced instructors. Whether you participate in one of our online or in-person classes, you will have opportunities to engage with experts through interactive activities and question-and-answer sessions that help you develop your understanding along with practical skills.

770-410-1219

770-410-1219

These Certified Payroll Certification courses online also allow you to learn at your own pace without time out of the office - and to earn payroll certification courses that can enhance your pay and your career!

These Certified Payroll Certification courses online also allow you to learn at your own pace without time out of the office - and to earn payroll certification courses that can enhance your pay and your career!